Foresters

Foresters Non-Med "Your Term"

- Non-Med Term Up To $400,000 ages 18-55

- Non-med term up to $150,000 aged 55-80

- Living benefits built in

- Decisions within 10 MINUTES (in most cases)

- High Commissions (Over 100%)

Send Me The Top Commission Level And Online Contracting For Foresters Life!

Immediately

Foresters has been a staple for many final expense agents, but they just became a HUGE player in the term world. The competitive rates, combined with living benefits (easily sell over other carriers in the same price range) and non med for $400k and under…make Foresters a must have in any life insurance agent’s portfolio of products.

In fact, we’re using it as a core product in our call center.

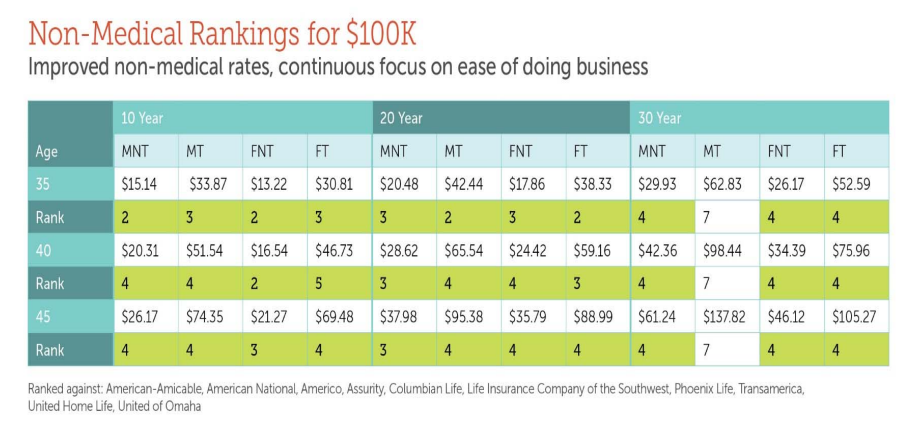

Take a look at some of the non-med rates and how they rank against other non-med companies… and keep in mind there’s benefits for critical, chronic and terminal illness included in these rates.

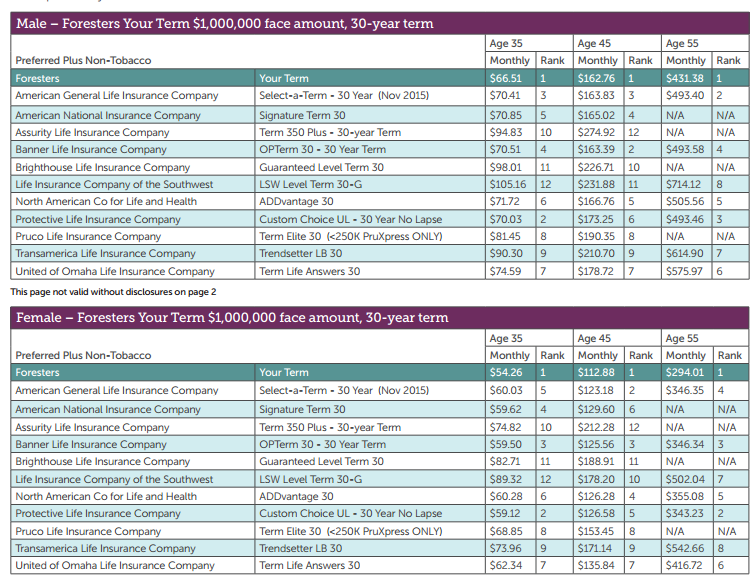

Here’s what the rates look like for fully underwritten term at $1,000,000. You’ll see they compete with all the big name term companies and again, don’t forget about the living benefits included in these rates!

Application Process

For Non-Med Term: Foresters uses iGo eApp which you can access within the Foresters portal. When you get an agent number, we have recorded video training showing you step by step the iGo eApp process – it’s very easy.

For Fully Underwritten Medical Term: You currently cannot sell this over the phone (but coming soon we’re told). So take a traditional application via iGo or paper. Then set an exam date (make sure it’s at least 7 business days out), time and location and email it to processing@digitalbga.com and we’ll set the exam, follow up on it and get it to Foresters once completed. Our case managers will work on your behalf and proactively manage the case and all outstanding requirements until it’s in offer stage when we send the offer over to you to present. If you wish to do your own exams, just let us know and we’ll note your file not to get involved.

For PlanRight Final Expense: Foresters uses a Point-of-Sale (POS) process to provide a medical eligibility decision while you are with the Proposed Insured. The process involves:

• an MIB, Inc. check

• a prescription history check

• a build chart review

• a Personal Health Interview (PHI)

The medical eligibility decision is derived from the results of the above along with the answers to the medical questions and the coverage applied for.

Foresters "Your Term" Resources

Foresters “Your Term” Product Reference Sheet

Foresters “Your Term” Product Guide (a more in depth one with health conditions is available to contracted agents)

Additional Information

Non-Med Foresters “Your Term”

- This is an accept/reject simplified issue life insurance plan. You either qualify for it, or you don’t.Many carriers these days have non-med products, but they still APS and weeks for a decision. Foresters will not pull an APS, they’ll simply accept it or reject the application and then you can pivot to an exam with Foresters or another product all together.

- The rates are based off of Standard rates, but you’ll see in the field underwriting guide that they’re very generous with common impairments like diabetes (accept if Type 2, under control on oral meds). Their field underwriting guide has a list of impairments that they will and won’t take – use it!

Critical Illness Benefits

Along with terminal illness and chronic illness benefits (losing 2 of 6 ADLs), these critical illness benefits are included at no cost to your clients.

Critical Illness benefits include lesser of (1) 95% of the eligible death benefit or (2) $500,000. You get access to this cash if any of the following happen:

– Life Threatening (Invasive) Cancer

– Myocardial Infarction (heart attack)

– Stroke

– Advanced Alzheimer’s Disease

– End stage renal failure

– Major organ failure

– ALS

Foresters Plan Right Final Expense

With this product, you also get access to Forester’s well known Plan Right final expense plan with very generous commissions + renewals. Fill out the form for commission information to be emailed to you.

However, it’s only available in 25 states if you’re selling over the phone. That state information is in the Foresters portal and DigitalBGA’s portal.

The Foresters Difference

Beyond the life insurance and living benefits, policy holders at Foresters enjoy many other benefits. These added benefits are sent to your clients and in return, you’ll get loyal clients for life. The persistency on Foresters business is higher than any other company we have because of all the added benefits Foresters reminds our clients of. Things like:

– Grants and scholarship your clients can apply for.

– Emergency assistance. Where your clients can apply for in case of significant personal hardship, disaster or large-scale emergency.

– Community grants. You can apply for financial grants to organize volunteer and fun family activities within your client’s community.

– Orphan scholorships. If both parents pass, this benefit provides a renewable scholarship for higher learning for up to 4 years.

– Orphan benefit. If both parents pass, Foresters may pay $900 per month per child to the legal guardian for children under the age of 18.

Plus many other benefits.

All of these above benefits are given to your clients who you write with Foresters.