DigitalBGA Index

DigitalBGA Carrier Index

DigitalBGA is not your typical BGA/IMO. We help you drive business, generate leads and increase efficiencies. We have developed the DBGA Index – an index of carriers with a proprietary calculation with factors including days to in force, placement ratios, policy fees and commission rates. Say goodbye to focusing your sales on higher commission rate products and hello to focusing on carriers with a higher DBGA index and adding revenue to your bottom line.

Example: For every $1,000 in premium written thru the carrier drop ticket processes equals only about $660 in commission to an agent when talking taking multiple applications over a period of time. Think about the $660 commission, not the commission rate. When running a business, you need to focus on revenue. How do you get more commission to hit your bank account? Follow the DBGA Index.

A carrier with a higher DBGA Index could yield as much as a 27% increase in commissions to your bottom line but also have a lower commission rate from the carrier overall.

Does yourDBGA Index mean you are paying me lower commissions?

No, absolutely not. We pay max agent compensation, or very close to it in most instances. We just share this information, because most BGAs don’t have the insights in the Digital space that we are in. Simply put, we help you write more business that sticks and gets paid.

Do you have extra incentive on high index carriers?

Absolutely. But, we only make money when you make money. We do this in order to provide valuable intelligence on carriers and processes that will in turn make you more money. We look at your bottom line, which fuels our bottom line. We have every incentive to help you make more commissions, vs. directing your business to a carrier that we know doesn’t convert, has a non commissionable policy fee or a process that doesn’t turn into paid policies.

I still don’t get it. Why would I sell a lower commission product when higher commission products are available?

Simple. Process, and numbers. If carrier A pays 110% but for every 10 cases you write with them, you only place 6, you are leaving a lot of money on the table. If carrier B pays you 90%, but you place 8 out of 10 policies, which one leaves you with more commission in your checking account? Assuming a $1000 case average, carrier B puts 9% more commission in your account, even though it is gross commission rate of 20% less.

While important, Digital Life Insurance Agents must stop thinking about commission rates only. A commission rate on paper doesn’t pay the bills.

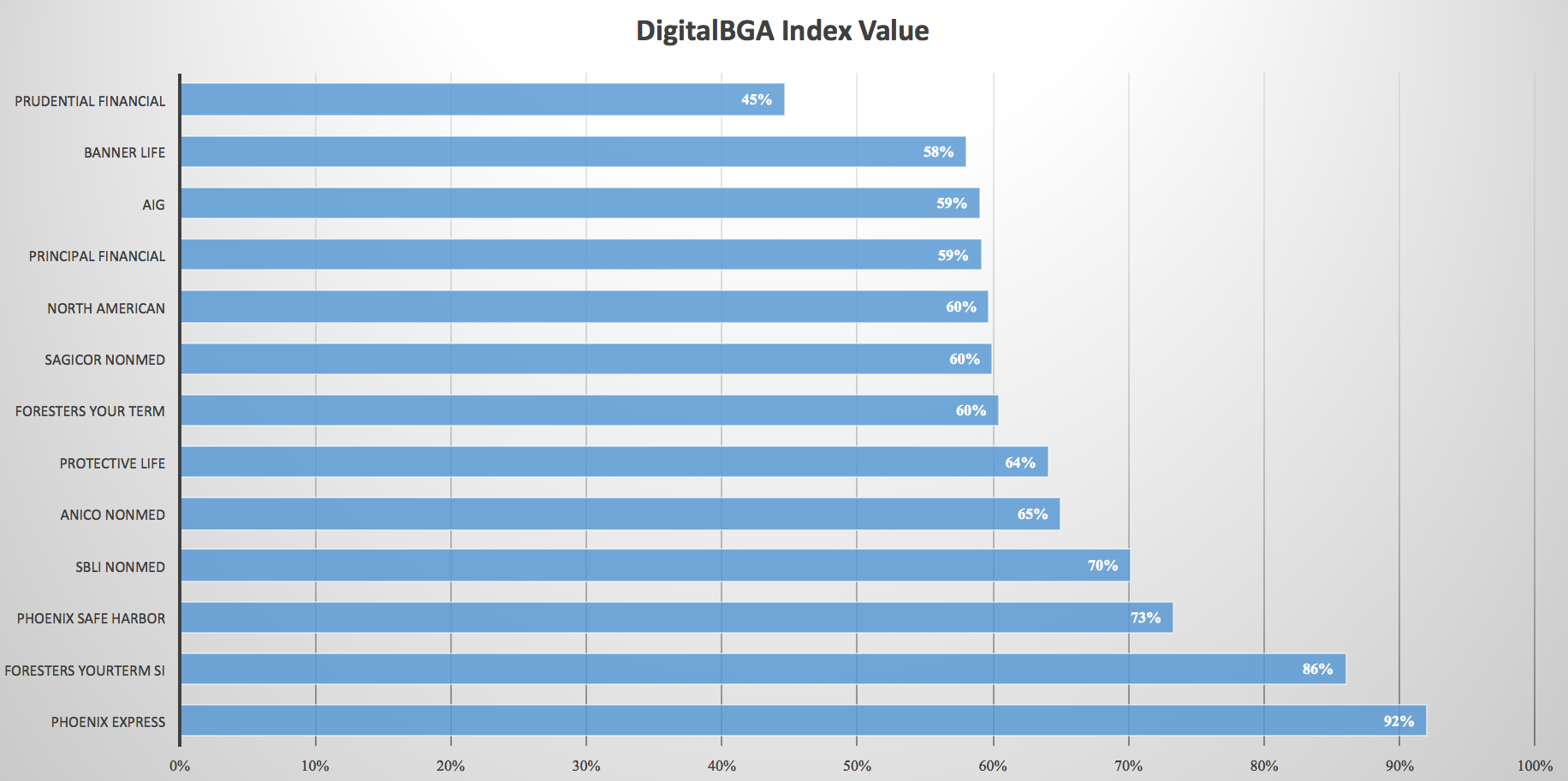

Current DigitalBGA Index of carriers:

So, for example, if you write a $1,000 case with Phoenix Safe Harbor Term Express, you can expect $920 in commissions coming to you, or $92% of the premium. This is after declines, a commissionable policy fee etc. Compare that to a sale with Principal Life where you would only collect $590, or 59%.

Simply put, follow the DigitalBGA Index to help you drive business to carriers with strong placement rates and you will earn more commissions. Period.

**check back often as this page updates regularly**