Guarantee Trust Life Heritage Plan

Almost Guaranteed Issue Life Insurance

Better rates than AIG and Gerber Guaranteed Issue with true social security billing.

For Agent Use Only

Brand new to the market as of April 15th is Guarantee Trust Life's Heritage Plan. It's an almost guaranteed issue life product with just 5 questions.

Most of your guaranteed issue business will qualify for this.

Here are the highlights:

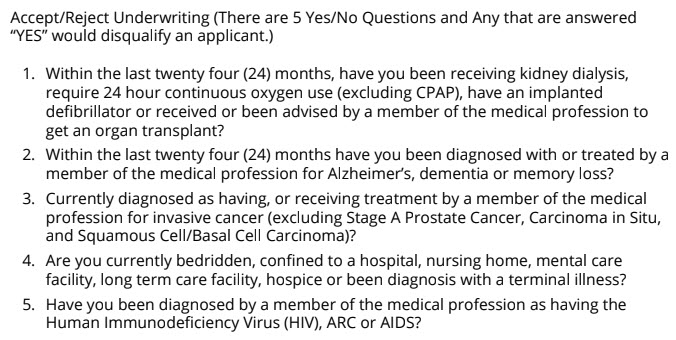

- 5 yes/no health questions on the application (questions displayed below). Any "Yes" answer and the application is declined. There is NO additional underwriting, ie. No Height/Weight, MIB, Rx or MVR.

- Online application process with integrated telephone signature. You take in their information online (client does NOT e-sign), then voice sign by calling into an automated recorded line.

- Social Security Billing for better persistency.

- Issue ages 40-90!

- 2 year graded death benefit. It's true graded in year 2.

- Better rates than all the guaranteed issue carriers out there.

- 75% commission with 10 years of renewals. 6 month advance up to $600 cap. Commissions paid weekly.

- Replacements are ok.

Why DigitalBGA for this contract?

- Conservation team included. Our conservation team will proactively reach out on your behalf to help with any billing issues, NSF's or pending lapses to protect your first year commissions and renewals.

- Open release policy. Want to switch uplines? We won't hold you hostage. We'll sign off on any releases as long as you don't owe any money to any carriers you have with us.

Guarantee Trust Life Heritage Plan

Issue ages: 40-90 years

Death benefit amounts: $2,500-$25,000

- Death Benefit in year 1 is premiums paid + 5%

- Death Benefit in year 2 is 50% of face amount

- Full 100% coverage in year 3

Who Is Guarantee Trust Life Company?

- 3rd Generation Family-Run Mutual Insurance Company

- Over 80 years of providing innovative insurance solutions.

- Upgraded to an A-(Excellent) Finanancial Strength Rating by AM Best

- Paid out over $100 million in hospital indemnity & cancer claims since 2017.